Меню

The Agency's activities are aimed at regulating and developing the insurance market, ensuring the financial stability of professional participants in the insurance market and maintaining confidence in the insurance system, ensuring consumers’ right protection of insurance services at appropriate level , creating equal conditions for the activities of participants in the insurance market and maintaining fair competition in the insurance market of Kazakhstan.

PARTICIPANTS OF THE INSURANCE MARKET

- Insurance (reinsurance) organizations

- The list of representative office of the insurance (reinsurance) company - resident of the Republic of Kazakhstan

- The list of representative office of the insurance (reinsurance) company-non-resident of the Republic of Kazakhstan

- Insurance brokers

- The list of representative office of the insurance brokers-non-resident of the Republic of Kazakhstan

- Actuaries

- "Insurance payments guarantee fund", JSC

- Mutual Insurance Associations

CONSOLIDATED SUPERVISION

LIQUIDATION PROCESS

REGISTERS OF PERMISSIONS AND NOTIFICATIONS

TESTING CANDIDATES

- Questions for the executive staff of the insurance (reinsurance) organizations, insurance holding, insurance brokers

- Questions for the executives of the "Insurance Payments Guarantee Fund" JSC

- Questions for testing candidates for the positions of chairman or member of the liquidation commission of a forcibly liquidated insurance (reinsurance) company

- Online broadcast of testing

ADDITIONAL INFORMATION

- Excluded agents

- Prohibited insurance (reinsurance) organizations-non-residents

- List of persons whose consent to occupy a leadership position has been revoked in the insurance sector

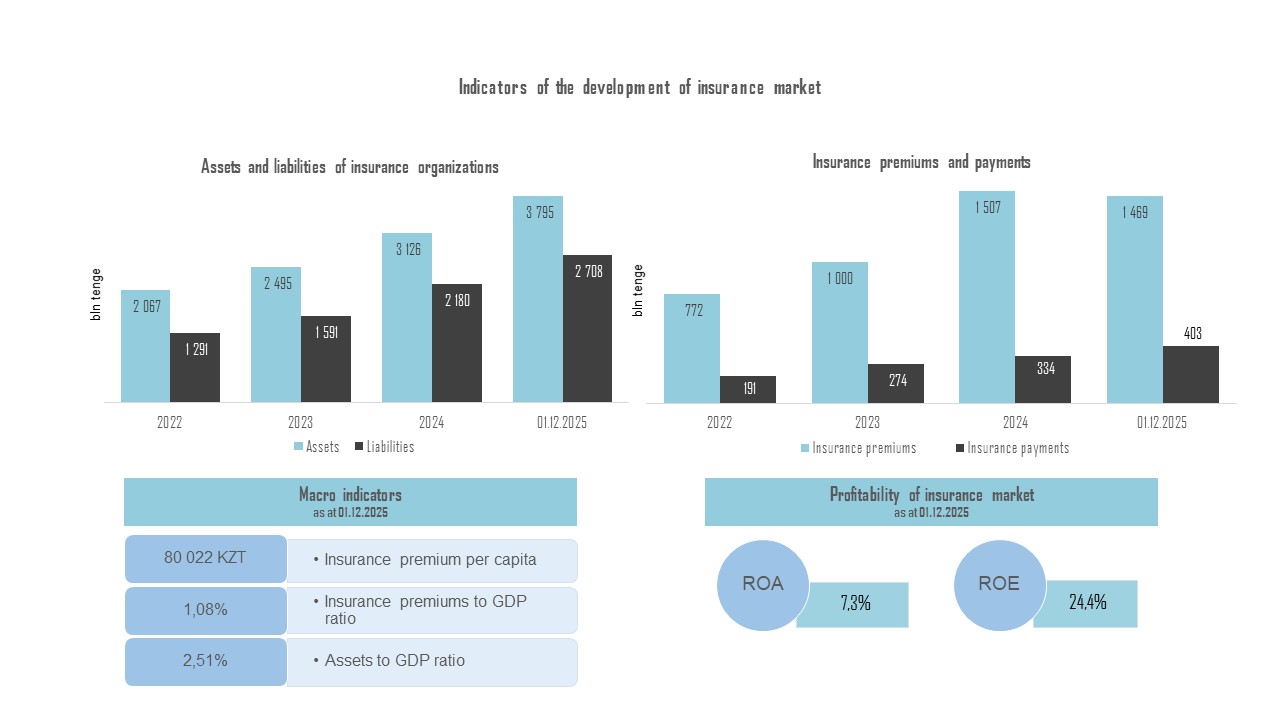

STATISTICS

Performance of financial sector:

THE SANCTION AND MEASURES OF INFLUENCE

Insurance Ombudsman Address: 28/7 Ryskulbekov Street, Almaty (Residential Complex "Bai-Tal")

Phone numbers: +7 (727) 382-41-74, +7 (727) 265-54-70, +7 771 990 58 27

Email: info@fomb.kz

The Insurance Ombudsman can assist you in resolving disputes with your insurance company.

As of January 1, 2024, contacting the Insurance Ombudsman is a mandatory step before initiating court proceedings in insurance-related disputes.

The institution of the Insurance Ombudsman has been operating in Kazakhstan since 2007.

The Insurance Ombudsman resolves disputes across all types of insurance where the policyholders (insured persons or beneficiaries) are individuals or small business entities. Other legal entities may contact the Insurance Ombudsman only in matters related to compulsory motor insurance.

The primary objective of the Insurance Ombudsman is to conduct an impartial, comprehensive, and objective review of the dispute and to issue a fair and lawful decision. The amount of claims submitted by individuals and/or other legal entities related to disputes under the compulsory civil liability insurance of motor vehicle owners must not exceed 10,000 times the monthly calculation index.

You can contact the Insurance Ombudsman directly at the following address: 28/7 Ryskulbekov Street, 2nd floor, Almaty. Alternatively, you can submit an appeal through the Ombudsman’s official website (www.omb.kz) or by email at office@omb.kz. In addition, the insurance company is obliged to forward the client's request to the Insurance Ombudsman if it was received through the company's branch, representative office, or website.

The decision of the Insurance Ombudsman is binding on the insurance company if the client agrees with the decision.

If the client disagrees with the Insurance Ombudsman’s decision, they have the right to seek legal protection through the court. When filing a claim with the court, the applicant must provide the decision of the Insurance Ombudsman as proof of having completed the mandatory pre-trial dispute resolution stage. https://adilet.zan.kz/eng/docs/Z000000126_

According to paragraph 3 of Article 220 of the Social Code of the Republic of Kazakhstan, a one-time pension withdrawal for the purpose of improving housing conditions for oneself, a spouse, or close relatives and/or for covering medical expenses for oneself, a spouse, or close relatives, may be made only if one of the following conditions is met:

- the amount of pension savings from mandatory pension contributions in the contributor’s individual pension account exceeds the minimum sufficiency threshold for pension savings, as determined in accordance with the methodology approved by the Government of the Republic of Kazakhstan;

- for individuals specified in paragraphs 1, 2, and 3 of Article 207 of this Code, as well as for individuals specified in paragraph 4 of Article 207, the amount of monthly pension or allowance provides a replacement ratio of at least 40 percent of their average monthly income, calculated according to the procedure established by the Government of the Republic of Kazakhstan. In calculating the replacement ratio, the recipient’s income prior to retirement is taken into account, but not more than the average monthly income in the country.

Therefore, pension savings that have been transferred to an insurance company under a pension annuity agreement cannot be used for the purchase of real estate.