Investments in Kazakhstan

Why is it worth investing in Kazakhstan?

In recent years, Kazakhstan has demonstrated high investment capacity due to a number of key factors:

- Strategic location – the country is located in the very center of Eurasia, being an important transport hub.

- Favorable business environment – government support, tax incentives and convenient conditions for doing business.

- Protection of investors’ rights – Kazakhstan provides a reliable legal framework and mechanisms for protecting capital investments.

- Investment incentives – a wide range of government programs and benefits for investors.

- Political stability is the predictable economic and political policy of a country.

- A rich raw material base – significant reserves of oil, gas, uranium and other natural resources.

- Human capital – skilled labor force and a growing number of specialists.

Виды предпринимательства

Kazakhstan is a key point at the intersection of Europe and Asia, which provides unique opportunities for trade and logistics.

Kazakhstan is a key point at the intersection of Europe and Asia, which provides unique opportunities for trade and logistics.

- The Great Silk Road passed through Kazakhstan, and today the country is part of the global One Belt, One Road initiative.

- Kazakhstan has preferential access to the regional market of more than 500 million consumers and to the Eurasian Economic Union (EAEU) market with 180 million consumers.

- Fast logistics:

- Europe – China – St. Petersburg: 10 days

- Europe – China – Hamburg: 16 days

- Europe – China – London: 18 days

- Transport corridors:

- The sea ports of Aktau and Kuryk are the access to the Caspian Sea and international trade routes.

- Ports in other countries – Kazakhstan has logistics infrastructure in Batumi (Georgia) and Lianyungang (China).

- The Western Europe – Western China Highway allows cargo to be transported between Europe and China in just 10 days.

Kazakhstan is a center of economic opportunities

Thanks to its favorable location, natural resources, developed infrastructure and investment incentives, Kazakhstan is becoming one of the most promising destinations for foreign investment.

Favorable investment climate in Kazakhstan

Kazakhstan creates comfortable conditions for investors, paying special attention to reducing administrative barriers, simplifying business procedures, and improving customs and tax administration.

Favorable tax regime

Kazakhstan ranks 5th in tax policy in the IMD world ranking.

- Reducing the tax burden: favorable rates on taxes and social contributions.

Simplified procedures for starting a business

- 1 day – registration of a legal entity.

- 3 days – registration of property rights.

- 100 days – obtaining construction permits.

State support measures

Special Economic Zones (SEZ) (14 zones)

- 0% – corporate income tax, land tax, customs duties and VAT on imported goods in the SEZ.

- 0% – property tax.

Industrial zones (50 zones)

- Developed infrastructure.

- Long-term lease agreements on favorable terms.

- No industry restrictions.

- Possibility of concluding an investment contract.

Investment Agreement

for large investment projects :

Reduction of tax liabilities up to 20 %.

Stability of legislation – guarantees for up to 25 years.

Reimbursement of up to 20% of construction and equipment costs.

Additional benefits provided by law.

Protection of investors' rights

Kazakhstan is actively developing mechanisms for protecting investments and trade and economic cooperation with other countries.

Key institutions for investor protection:

- Council of Foreign Investors under the President of the Republic of Kazakhstan.

- Coordination Council chaired by the Prime Minister of the Republic of Kazakhstan.

- Council for improving the investment climate under the Government of the Republic of Kazakhstan.

- The Court of the Astana International Financial Centre operates under English law.

- International Arbitration Centre.

- Specialized courts for investment disputes.

- Investment Ombudsman – Prime Minister of the Republic of Kazakhstan.

Human capital

31st place in the Human ranking Capital Index-2018 of the World Bank.

100% literacy of the population.

Visa-free regime for citizens of more than 65 countries, including OECD countries. 128 universities, of which 8 are included in the top world rankings (QS Stars Development Road Map).

Within the Bolashak program more than 10,000 specialists were studied and trained in 100 leading universities in the world.

Kazakhstan offers investors unique opportunities thanks to a combination of strategic location, favorable tax regime, developed infrastructure and reliable investment protection mechanisms.

Режимы налогообложения для малого бизнеса

Today, the priority areas for development of Kazakhstan are the following sectors:

Agro-industrial complex

Kazakhstan is the ninth largest country in the world by area. More than 210 million hectares are agricultural lands, making agriculture and food industry one of the key sectors of the economy, providing more than 7% of the country's gross value added (GVA).

Ecologically clean products – Kazakhstan ranks first in the world for the lowest levels of chemical use in growing crops (only 0.1 tons per hectare).

Grain power – Kazakhstan annually exports 5-8 million tons of grain to more than 70 countries around the world.

The world leader in flour exports, the country consistently occupies a leading position, exporting up to 2.5 million tons of flour per year.

Factors of investment attractiveness:

- Rich land resources.

- Skilled human capital – about 20% of the working population is employed in agriculture.

- Workforce readiness – 50% of the country's population lives in rural areas and is actively involved in the agro-industrial complex.

Kazakhstan creates favorable conditions for investors in the agricultural sector, offering significant resources and favorable business conditions.

Animal husbandry in Kazakhstan

The livestock industry of Kazakhstan includes eight main areas, producing a wide range of products: meat, milk, eggs and other goods obtained because of breeding livestock and poultry.

Main regions of livestock farming

About 56% of all agricultural, forestry and fisheries enterprises are concentrated in three key regions:

- Turkestan region – 25%

- Almaty region – 17%

- Akmola region – 14%

Thanks to the vast pasturelands in Kazakhstan, pasture livestock farming is widely developed, including the breeding of:

Sheep and goats

Cattle Horses Pigs

Camels

Import dependence and product shortages

Kazakhstan is dependent on imports in a number of livestock product segments:

Meat and meat by-products (salted, in brine, dried, smoked).

Cattle, sheep, goat and pig fat.

Ready-to-eat and canned meat products (including sausages and similar products) – moderate deficit.

Poultry meat and edible by-products – slight dependence on imports.

Raw cow's milk – annual deficit of 1 million tons.

Export capacity to the EAEU countries and China

Kazakhstan has significant capacity for exporting livestock products:

Beef - up to 480 thousand tons per year.

Lamb - about 100 thousand tons per year.

Pork - 86 thousand tons per year.

Chicken eggs - 300 million pieces per year.

Kazakhstan's livestock sector is actively developing, offering promising opportunities for investors and expanding export capacity.

Plant growing in Kazakhstan

Crop production is one of the key areas of agriculture in Kazakhstan and includes two main segments:

Growing seasonal and perennial crops

Production of fertilizers to improve soil fertility

Main crops

Cereals and oilseeds :

- Wheat, barley, oats, corn

- Sunflower, rapeseed, soybeans, flax, rice

Vegetables and fruits :

- Cucumbers, tomatoes

- Apples, cherries, pears, berries

Production of vegetable oil

The production of vegetable oil is one of the most promising areas of plant growing.

Access to raw materials – the area under oilseed crops has reached 3 million hectares.

By 2030, it is planned to increase the area to 5 million hectares.

The Northern Soybean Program:

- Within 5 years, the area under soybeans will increase to 1.5 million hectares.

- The gross harvest of soybean seeds will exceed 3 million tons.

Export capacity

Export of oilseeds is more than 1 million tons per year.

- Main importers: Uzbekistan, China, Belgium.

Export of processed products – over 300 thousand tons .

- Includes vegetable oils : sunflower, rapeseed, soybean, linseed.

- China is one of the largest buyers.

Export of meal and cake (by-products of oilseed processing).

- Main markets: Russia, Uzbekistan .

Development Prospects

Kazakhstan is actively expanding its crop areas and processing capacities for plant materials, which makes the crop production sector attractive to investors and contributes to the growth of agricultural exports.

Industry of Kazakhstan

Light industry is one of the priority areas of development of the economy of Kazakhstan. It is a complex industry, including more than 20 sub-industries , which can be combined into three main groups:

Textile industry

- Cotton, wool, silk, knitwear industries

- Primary processing of wool

- Production of non-woven materials

- Net-knitting, felting industry

Garment industry

Leather, fur and footwear industry

Current situation and trends

According to Global analytics Research & Data Services, in Kazakhstan there is a stable demand for textile products (primarily clothing).

However, half of the cotton fibre – a key raw material for the textile industry is exported, indicating insufficient processing within the country.

Despite having a rich raw material base, Kazakhstan remains dependent on imports products with high value added.

Global demand for light industry products increases by 2.2% annually, but Kazakhstan’s clothing industry covers only 7% of domestic demand.

Structure of production of textile industry

Cotton

Fabrics

Textiles

Materials

Felt

Shoes

Development Prospective

To increase the competitiveness of the light industry in Kazakhstan it is required to:

- Increase the capacity for deep processing of raw materials.

- Develop the production of products with high value added.

- Reduce dependence on imports and increase the share of domestic products in the domestic market.

- Implement modern technologies and improve the skills of personnel in the industry.

Kazakhstan has great capacity for the development of light industry and can become a significant player in the regional and international markets.

Chemical industry of Kazakhstan

The chemical industry is one of the most capital-intensive sectors of the economy of Kazakhstan. It is conventionally divided into the four main sectors:

Agrochemistry (mineral fertilizers, pesticides)

Petroleum chemistry

Basic chemistry (inorganic acids, alkalis, salts, varnishes, paints, explosives)

Consumer chemistry (detergents and cleaning agents)

Structure of production of chemical industry

Key industry segments:

- 64% – Basic chemistry (production of acids, alkalis, explosives, varnishes and paints)

- 21% – Agrochemistry (mineral fertilizers and pesticides)

- 10% – Oil and gas chemistry (represented by one large enterprise)

- 5% – Consumer chemicals (detergents and cleaning products)

Capacity and problems of the industry

Production of mineral fertilizers

Kazakhstan has great capacity for the production of mineral fertilizers, the main component of which is ammonia. However, the country is dependent on imports: 20-30 thousand tons of ammonia used in agriculture are imported annually.

Production of petrochemical products

There is capacity for the production of chemical products in demand in the petrochemical industry:

- Caustic soda

- Hydrochloric acid

- Hypochlorite

- Calcium

- Coagulants

Production of base oils

Kazakhstan has a raw material base for the production of base oils - the main component of lubricants used in industry and transport. There is no production of base oils in Kazakhstan. Lubricants are made on the basis of imported raw materials from Uzbekistan.

Development Prospective

Establishment of new enterprises for processing chemical raw materials.

Development of ammonia production to reduce import dependence.

Development of the petrochemical industry, including the production of caustic soda, acids and other products.

Establishment of production of base oils, which will allow Kazakhstan to reduce dependence on imports and develop export capacity.

Kazakhstan's chemical industry has significant growth capacity, and with a comprehensive approach to developing the industry, the country can become a regional leader in chemical production.

Construction industry of Kazakhstan

The construction industry of Kazakhstan demonstrates high growth rates and is a priority area for investment.

The construction industry has nearly doubled in size over the past five years, with Market line forecasting an average annual growth rate of 8.4% from 2021 to 2023.

Factors of industry growth:

Population growth and, as a result, increased demand for real estate.

Government programs to support construction.

Rich raw material reserves for the production of building materials.

Raw materials base and production of building materials

Extraction of minerals and construction raw materials increased by 68 %. Kazakhstan's production capacity allows it to cover 60%–85% of domestic demand for the following materials:

- Gypsum

- Clay bricks

- Refractory products

Domestic production fully satisfies the demand for:

- Ready-mix concrete

- Cement

- Construction solutions

There is significant capacity for increasing production volumes for export purposes.

Geography of production

There are about 1,000 enterprises producing construction materials in Kazakhstan.

The main production facilities are concentrated in:

- Akmola region – 35%

- Almaty region – 14%

- Astana city – 10%.

The reason for such concentration is the active dynamics of construction in Astana and Almaty.

Prospective and development opportunities

Development of export of construction materials.

Attracting investments in production of modern and innovative construction materials. Increasing capacities to cover 100% of domestic demand and entering international markets.

Thanks to active government support and growing demand for real estate, the construction industry of Kazakhstan remains one of the most promising and investment are attractive sectors of the economy.

Mining and metallurgical complex of Kazakhstan

Metallurgy is the backbone of Kazakhstan's economy , providing a significant contribution to industrial production and exports.

Mineral resources

Kazakhstan is the world leader in tungsten reserves (1st place).

It ranks the 2nd in the world in uranium and chrome ore reserves.

The top 5th in manganese, silver, zinc, lead reserves.

6th place in the world in total natural resource reserves.

10th place in the world in mineral extraction (excluding oil and gas).

Of the 105 chemical elements in the periodic table, 99 have been discovered in Kazakhstan, 70 of which have been explored and 60 are being actively mined.

The subsoil of Kazakhstan also contains reserves of rare earth metals such as rubidium, cesium, lithium, and beryllium.

Production growth

The volume of non-ferrous metal production increased by 12 %.

Ferrous metallurgy demonstrates positive dynamics – the production volume index increased from 98.3% to 101.3%.

Main growth factors:

Increase in copper and lead-zinc ore mining.

Growth in production of ferroalloys, steel and steel products.

Prospects and investment opportunities

Development of processing and increase in export of finished metallurgical products. Development of new deposits of rare earth metals.

Attracting investments in deep processing of metals to create products with high value added.

The mining and metallurgical complex of Kazakhstan remains one of the most promising industries, attracting the attention of large international investors.

Mechanical engineering of Kazakhstan

Mechanical engineering is one of the priority areas of the economy of the Republic of Kazakhstan. Currently, the volume of imports of products in this industry is about 40% of the country's total imports.

Promising directions

Electrical equipment Manufacturing

Oil and gas equipment

Automotive industry

Other machines, equipment and machine tools

Advantages of the industry

- Raw materials – Kazakhstan has the necessary natural resources for production.

- Competencies – highly qualified labor and a developed scientific research base.

- Technologies – access to modern and innovative technologies for production.

- Stable demand – constant internal and external consumption of engineering products.

- Competitive environment – the presence of competitive domestic producers.

- Logistics – a developed transport infrastructure for efficient delivery of products both within the country and for export.

Growth and export capacity

The mechanical engineering industry of Kazakhstan has significant capacity for expanding production and increasing exports. Development of a new range of products is possible on the basis of existing production capacities of domestic enterprises specializing in similar products.

Mechanical engineering in Kazakhstan continues to develop, opening up new opportunities for attracting investment and expanding foreign trade.

Energy and Renewable Energy Sources (RES) of Kazakhstan

The total installed capacity of power plants in Kazakhstan is 23.6 GW, and the available capacity is 19.1 GW.

The Path to a Green Economy

Kazakhstan is currently actively implementing measures to regulate greenhouse gas emissions, striving to transition to a "green economy". The key objective is to achieve the following indicators:

- 10% share of renewable energy sources in total electricity production by 2030.

- 50% share of renewable energy sources by 2050 , including alternative energy.

Renewable Energy Capacity in Kazakhstan

Kazakhstan has significant capacity for the development of renewable energy sources, which is estimated at more than 1 trillion kWh per year. Of greatest interest to the country are:

- Wind energy

- Hydropower

- Solar energy

- Thermal capacity of geothermal waters

These resources have enormous capacity for creating a sustainable and environmentally friendly energy system.

Hydrogen Energy Development

One of the key areas of transition to a low-carbon economy and decarbonization of the fuel and energy complex of Kazakhstan is hydrogen energy development. In particular, Kazakhstan's strategy is focused on the production and consumption of predominantly "green" hydrogen, which is closely linked to the development of solar and wind energy and the efficient use of water resources.

The Future of Energy in Kazakhstan

Kazakhstan is taking important steps towards sustainable and clean energy, which opens up prospective for attracting investment and creating innovative technologies in the field of renewable energy sources. Strategic initiatives in the field of hydrogen energy and green economy make Kazakhstan one of the leaders in the field of sustainable development in Central Asia.

Kazakhstan is taking important steps towards sustainable and clean energy, which opens up prospective for attracting investment and creating innovative technologies in the field of renewable energy sources. Strategic initiatives in the field of hydrogen energy and green economy make Kazakhstan one of the leaders in the field of sustainable development in Central Asia.

Healthcare and Pharmaceuticals in Kazakhstan

Healthcare and pharmaceutical industries in Kazakhstan have great capacity for further development. The existence of state support, growing demand for drugs, as well as the introduction of new standards and laws that promote the modernization of industries, create favorable conditions for the growth of production capacity of local enterprises. This will not only reduce import dependence, but also increase the export of pharmaceutical products.

Main production regions

About 91% of pharmaceutical production is concentrated in two key regions:

- Shymkent - 84%

- Almaty region - 7%

There are 85 pharmaceutical companies operating in Kazakhstan, including:

- 49 drug manufacturers

- 27 manufacturers of medical devices

- 9 manufacturers of medical equipment

Promising areas for investment

The most attractive niches for investment in the healthcare and pharmaceutical sectors are:

- Vitamins

- Antibiotics

- Syringes and other consumables

- Medicines and various drugs

- Cotton, gauze, bandages

- Human vaccines

- Medical devices and accessories

Today, there are 96 pharmaceutical companies operating in the country, of which:

- 33 enterprises are engaged in the production of medicines

- 41 enterprises produce medical products

- 22 companies produce medical equipment

The healthcare and pharmaceutical sector of Kazakhstan is on the path of active development, and thanks to state support, expansion of production capacity and increased domestic demand, it has every chance of becoming an important part of the economy, providing the country not only with essential medical products, but also with export capacity.

Geology and subsoil use in Kazakhstan

The mineral resource base of Kazakhstan is rich in various deposits, including fuel and energy resources (hydrocarbons, coal, uranium), as well as reserves of ferrous, non-ferrous, precious and rare metals, non-metallic minerals and groundwater. There are 113 minerals types registered by the state in the country.

Capacity for new discoveries

Despite the large number of deposits already being developed, experts believe that the subsoil of Kazakhstan retains significant capacity for new discoveries. One of the most promising areas is geological exploration of solid minerals. Particularly large prospects are associated with gold ore deposits. Most of these deposits are concentrated in the third part of the Kostanay region, in the central and eastern parts of Kazakhstan, as well as in the south, near the border with Kyrgyzstan.

State geological exploration program

In response to the need for the development of geological exploration, on the instructions of the Head of State, the State Geological Exploration Program of the Republic of Kazakhstan for 2021–2025 was developed. The main program objective is to increase geological exploration of the country's territory, which will ensure the stable development of geological exploration and replenishment of mineral resource base.

The program includes the study of “deep horizons” in mining areas, and its implementation has been carried out through the state budget and private investment.

Investment Opportunities and Financing

Investors are interested in areas that have already undergone preliminary geological study. For this purpose, the state finances the early stages of geological exploration, which significantly increases the investment capacity of areas that are transferred to subsoil use. This allows for the acceleration of the processes of extraction and development of natural resources.

Digitalization in geological exploration

Within the framework of the state program Digital Kazakhstan a project is being implemented to create and implement the information system "National Mineral Resources Database of the Republic of Kazakhstan" (NMRDB). The system will collect geological reports, balances of mineral reserves, deposit passports and other important information in a single database.

One of the key tasks of the NMRBD is the introduction of the "single window" principle, which will simplify the access of investors and subsoil users to subsoil use processes. The introduction of this system will also automate processes such as issuing licenses, providing reports and monitoring the fulfillment of obligations.

New code and legislation

In 2018, the new Code of the Republic of Kazakhstan "On Subsoil and Subsoil Use" came into force, which is fully consistent with the best international practice, in particular the Western Australian model. This code opens up new opportunities in geological exploration, and is also aimed at attracting investors, including junior companies, which, as world practice has shown, discover more than 60% of new deposits.

Kazakhstan continues to actively develop its geological exploration and subsoil use industries, which creates prospects for new discoveries and expansion of mineral extraction. The introduction of modern technologies and legislative changes, as well as the active attraction of investors, contribute to the sustainable development of the country's mineral resource base.

New technologies (digitalization and IT)

The electronics and equipment manufacturing sector is actively developing in Kazakhstan . Currently, there are 64 enterprises operating in the country that manufacture electronic goods. Of these, about 20 companies (31%) specialize in communications equipment, and 9 companies produce computer equipment.

The electronics industry of Kazakhstan has a huge capacity for further growth. State support, as well as the growing demand for electronic goods, are becoming key factors contributing to the increase in the production capacity of Kazakhstani enterprises. This, in turn, allows not only to reduce import dependence , but also to increase exports.

Priority projects and directions

Priority investment projects in the field of new technologies include the following areas:

- Electronic components and boards;

- Computers and peripherals;

- Communication equipment;

- Electronic household appliances;

- Instruments and devices for measurements and testing;

- Electromedical equipment ;

- Optical instruments;

- Magnetic and optical storage media.

These industries represent high-tech and promising sectors that can significantly increase the country's production capacity and competitiveness in the future.

Export capacity

Given its geographical proximity, Kazakhstan has great export capacity to the countries of Central Asia and the EAEU. The main markets for Kazakhstani electronic products could be Russia, Uzbekistan , Kyrgyzstan, Tajikistan and other neighboring countries. Using the advantages of the EAEU creates good opportunities for Kazakhstan to take a worthy share in the structure of imports of new technologies in these markets.

Thus, the development of the electronics and IT industry in Kazakhstan opens up new opportunities for strengthening positions in the international arena and reducing dependence on foreign supplies.

Tourism in Kazakhstan

Kazakhstan, due to its advantageous geopolitical position and significant natural and recreational resources, has enormous capacity for tourism development. The country is known for its unique natural diversity and many objects of world cultural and historical heritage. The UNESCO World Heritage List includes 11 objects, which emphasizes the cultural value of the region.

Taking this into account, Kazakhstan has all the prerequisites for becoming a major player in the global tourism arena, developing new tourism products and increasing tourist flows.

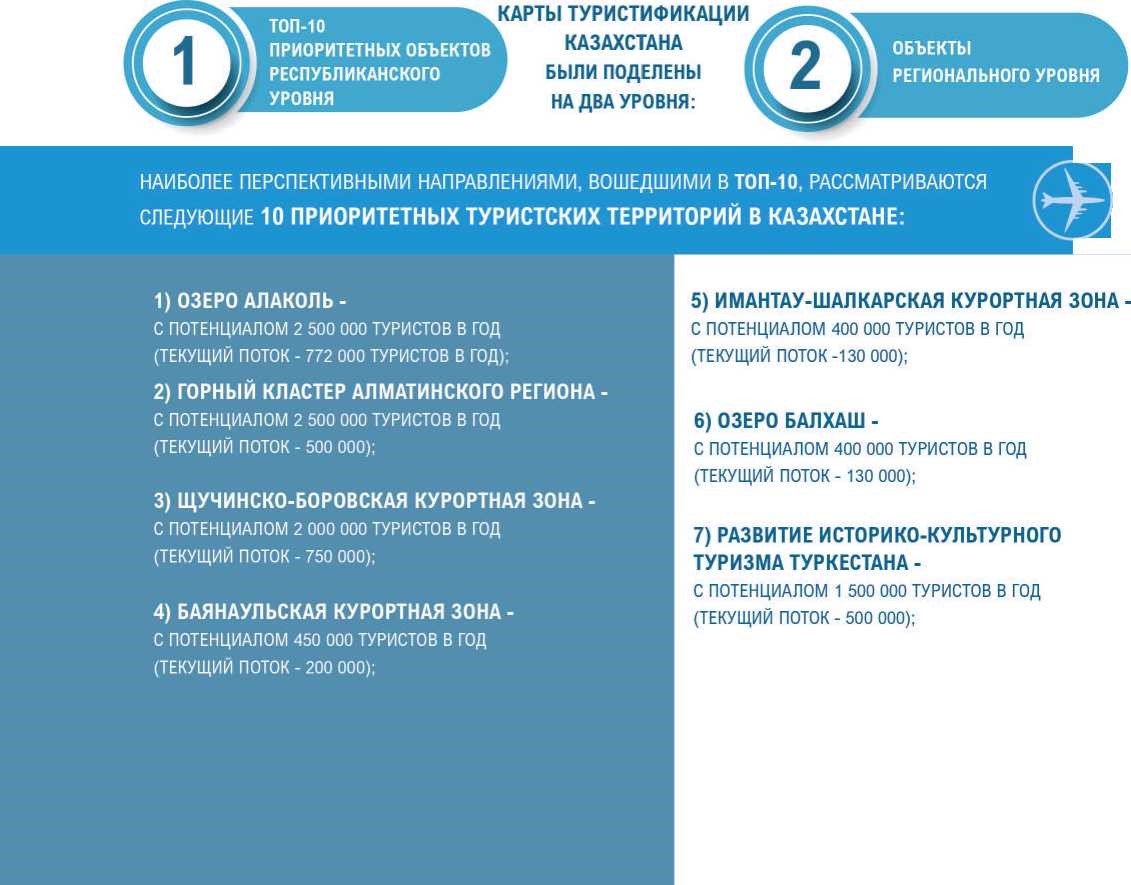

State tourism development program

To stimulate the growth of the tourism industry in Kazakhstan, in 2019 the state program for tourism development for 2019–2025 was approved. The program is aimed at creating favorable conditions for tourism development in the country, including strategic planning and reducing barriers for investors. The objective of the program is to increase the share of tourism in Kazakhstan's total GDP to 8% by 2025.

The Future of Ecotourism

According to forecasts from the World Tourism Organization (UNWTO), ecotourism will develop rapidly in the next two decades. Global spending on ecotourism will grow faster than on the entire tourism industry as a whole, which opens up significant opportunities for Kazakhstan, which has unique natural resources.

Tourist attractions of Kazakhstan

Currently, there are more than 100 tourist sites in Kazakhstan , the so-called "tourist magnets" and "tourist growth points". In order to further attract investment in the development of these sites, a map of Kazakhstan's tourism was developed, which highlights the most promising places for tourist attractiveness and infrastructure development.

Thus, tourism in Kazakhstan has enormous capacity, and the implementation of the state tourism development program will allow the country to strengthen its position in the global tourism market, attracting an increasing number of tourists from all over the world.

Аутсорсинг: что это и как помогает бизнесу?

The Astana International Financial Centre (AIFC) is an independent jurisdiction that began its operations in 2018. It is a unique platform for the region with a special legal status, providing its participants with privileges and opportunities for development. According to the AIFC Development Strategy until 2025, its key objective is to become a universal platform linking the countries of the EAEU, Central Asia and the Caucasus.

Strategic directions for the AIFC development

AIFC develops its activities in the following key areas:

- Capital market

- Asset and cash management

- Insurance and reinsurance

- Banking services

- Financial technologies

- Green finance

- Islamic finance

These areas provide new opportunities for both investors and businesses. Investors are offered securities of both state and private issuers from Kazakhstan and other countries in the region, as well as a variety of business projects, from large initiatives to small start-ups. Businesses have access to investors, including international financial institutions, as well as to asset management and Islamic finance services.

Advantages of AIFC

The AIFC has a number of advantages, including:

- Regulation of activities based on acts developed according to the principles of the common law of England and Wales, which corresponds to international standards.

- The presence of an independent AIFC Court and Arbitration Centre based on international judicial practice.

- Exemption from corporate tax on income from specific financial services and securities transactions until 2066.

- A wider range of opportunities for currency transactions compared to the general jurisdiction of Kazakhstan.

- Special visa regime for foreign citizens and stateless persons.

- Flexibility of regulation, which is especially important for companies operating in the field of new technologies and finance.

Jurisdiction of the AIFC

The AIFC judicial system is based on the common law principles of England and Wales, making it unique in Central Asia. The AIFC Court has exclusive jurisdiction to resolve disputes related to the activities of the center and by agreement of the parties. The International Arbitration Centre (IAC) provides alternative dispute resolution methods, including arbitration and mediation.

AIFC Regulator (AFSA)

The Financial Services Authority (AFSA) works to create a trustworthy regulatory regime for investors and businesses. In its first five years of operation, more than 1,600 companies from 67 countries were registered. The regulator adheres to the best international standards and is actively involved in creating favorable conditions for investors, including the implementation of currency regulation rules.

Astana International Exchange (AIX)

AIX was created to develop an active capital market in Kazakhstan and Central Asia. The exchange provides a reliable trading infrastructure and actively attracts both local and foreign investors. An important initiative is the TABYS 2.0 mobile application, which allows citizens to invest in global and local stock markets.

Green finance

AIFC is actively developing the green finance market, creating conditions for issuing green bonds and promoting sustainable financing. The Green Finance Centre provides support to issuers and investors, and also introduces legislative changes to stimulate business in the environmental sector.

Islamic finance

The development of Islamic finance is one of the key strategies of the AIFC. All necessary conditions have been created for this, including the legislative framework and a roadmap until 2025. The AIFC provides exemption from corporate taxes for Islamic financial institutions and actively develops the ecosystem of Islamic finance both in Kazakhstan and in the region.

The AIFC continues to develop its role as a key financial platform for Kazakhstan and Central Asia, providing attractive conditions for international investors and businesses.

Financial technologies

Tech Hub AIFC - the tasks of the division include promoting the development of the startup ecosystem, the venture industry market, e-commerce, corporate innovation and new technological areas in Kazakhstan (FinTech , GovTech , SatelliteTech , Industry 4.0 , etc.). Together with international partners, Tech The Hub conducts programs to support market players, facilitates the structuring of venture deals and testing of new fintech solutions within the regulatory sandbox of the AIFC jurisdiction.

The Affiliated Centre for the Fourth Industrial Revolution of the World Economic Forum operates on the AIFC platform. The resources of the Affiliated Centre allow for the formation and improvement of policies and principles for regulating big data, the Internet of Things, artificial intelligence and machine learning, blockchain, etc.

At present, more than 200 technology, ICT and fintech companies from around the world have already registered in the AIFC jurisdiction, and work is also ongoing to attract market participants in the development of technology in the field of artificial intelligence, blockchain and big data, as well as information security from different countries to the AIFC platform.

Tech Hub is working on developing venture capital through the Venture platform Rocket Eurasia, where more than 100 startups are already registered.

BCPD (Bureau of Continuing Professional Development)

The AIFC operates the Bureau for Continuous Professional Development (BCPD), which aims to develop human capital and create conditions for lifelong learning.

BCPD's core mission is to contribute to sustainable, inclusive and resilient economic development in Kazakhstan and the Central Asian region by developing the capabilities and shaping the thinking of current and future leaders.

During the BCPD's operation, more than 8,000 specialists have been trained under international certification programs. Many were able to obtain high-paying jobs in large companies and/or career advancement within six months of receiving the status of a certified professional. A personnel reserve of the AIFC has been formed from professionals in the field of financial and investment management, audit, AML, project management, human resources management, etc.

The following projects operate on the BCPD basis.

Alpharabius Academy is a school for future leaders created by BCPD in cooperation with the Republican Physics and Mathematics School of Astana. Alpharabius Academy aims to educate the leaders of the future, who, in addition to a strong school physics and mathematics base, will have developed skills in programming, finance, law, and soft skills.

In 2020, the BCPD team launched the QWANT programming school . Now QWANT is a successful player in the open market, on the basis of which specialists for the digital economy are trained. In 2021, the QWANT programming school entered the TOP-100 most innovative companies of the international HolonIQ rating out of more than 2,000 startups in the region.

In 2021, the BCPD was joined by the Academy of Law, an educational project of the AIFC, which is a provider of unique legal educational services based on the high standards of applicable English common law and the AIFC jurisdiction. The Academy of Law provides a full range of courses and certifications within the current jurisdiction based on English law, provides pro-bono consultations for participants and conducts internships for young professionals.

At the beginning of 2021, a course was taken towards digitalization. The LMS platform and marketplace were launched University of the Future to prepare professionals with competencies in finance, law and developed soft skills. The project implements three important areas: preparation for passing international certification programs, short-term business trainings and corporate business trainings.

BCPD also implements its own HR- tech solution A-PRO with a built-in machine-learning module for maximum matching of market expectations with talent pool profiles for employment and market professionalization purposes. The A-PRO platform allows you to manage candidate databases, conduct digital recruiting, create a career development trajectory for employees, implement digital internships, maintain an HR blog and create events. The A-PRO project is aimed at developing human capital in Kazakhstan companies, as well as providing corporate services in recruitment, out staffing, outsourcing of operational processes, HR and IT services and selection of a project-integrated team.

AIFC Expat Center

The Expat Center is a unique platform for providing a wide range of public and social services for foreign experts and investors, on a one-stop-shop basis in English. In particular, the required public services for entry, stay and comfortable localization in the territory of the Republic of Kazakhstan of foreign experts, investors and their family members, as well as consulting support services.

The Center takes an active part in working groups of government agencies on issues of optimizing visa and migration procedures and their digitalization.

Continuing the work on digitalization of public services, digital solutions have been introduced within the framework of the AIFC Expat Center, thanks to which a number of certain services are available online.

Based on the principle of "client centricity" and high quality of services provided, the AIFC Expat Centre provides turn-key services to corporate clients to assist in attracting, hiring and localizing foreign experts and investors.

The Expat Centre is focused on improving its infrastructure and plans to expand the range of services provided, as well as introduce new projects to increase the investment attractiveness of Astana and the country as a whole.

Начать бизнес можно на гранты от государства

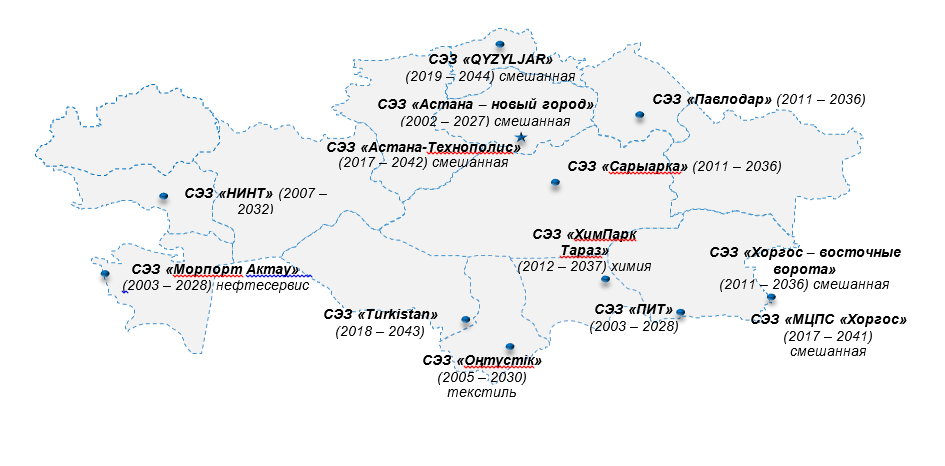

Special economic zones (SEZ) in Kazakhstan are created with the aim of accelerated development of regions, improving the integration of the country's economy into global economic processes, creating highly efficient, including high-tech and competitive industries. They are aimed at developing new types of products, attracting investments, improving legal norms of market relations, introducing modern management and economic methods, as well as increasing the tourism capacity of the region and developing tourism infrastructure capable of satisfying the needs of both Kazakhstani and foreign tourists. In addition, SEZs solve social problems by creating jobs and improving the quality of life in the regions.

The SEZ is a part of the territory of the Republic of Kazakhstan, where a special legal regime is in effect, providing the necessary conditions for conducting activities in priority sectors.

Today, there are 14 SEZs operating in Kazakhstan, each of which is focused on a specific industry. The zones began their activities in 2002. Within the framework of these SEZs, 372 projects were implemented, which allowed the creation of more than 27 thousand permanent jobs.

Participants of SEZ are provided with significant benefits, such as:

- Exempt from corporate, land and property taxes;

- The VAT rate on goods sold in the territory of the SEZ is 0%;

- Free provision of land plots for the entire period of the SEZ with the provision of all necessary infrastructure;

- Exemption from rent and land tax.

JSC "Kazakhstan Center of Industry and Export "QazIndustry"" is a coordinator of SEZ in Kazakhstan. The main tasks of the center are to develop, promote and increase the investment attractiveness of special economic and industrial zones, as well as support businesses operating in these territories.

Меры нефинансовой поддержки предпринимателей

An industrial zone is a territory provided with all the necessary engineering and communications infrastructure, intended for the placement and operation of business facilities. It covers various sectors, including industry, the agro-industrial complex, the tourism industry, transport logistics and waste management, in accordance with the legislation of the Republic of Kazakhstan.

The purpose of creating industrial zones is to develop entrepreneurship in the regions, provide infrastructure for business, attract investment, promote exports, create import-substituting industries and new jobs.

The benefits of businesses participating in industrial zones include:

- Provision of land plots;

- Ready-made infrastructure, prepared for doing business;

- Possibility of long-term lease or purchase of a land plot at cadastral value;

- No industry restrictions;

- Possibility of concluding an investment contract with an authorized body.

Currently, there are 50 industrial zones operating in Kazakhstan.

Центры развития женского предпринимательства

Digital transformation is the process of implementing modern technologies to improve the productivity and value of an enterprise in the modern world.

Key benefits of digital transformation include:

- Cost reduction;

- Improving the quality of services and products;

- Increased productivity.

One of the priority tasks of the Kazakhstan Industry and Export Center "QazIndustry" is the digital transformation of manufacturing enterprises through the introduction of digital technologies into business processes.

To promote and implement domestic digital solutions in the Kazakh industry, QazIndustry, with the support of the Ministry of Industry and Infrastructure Development of the Republic of Kazakhstan, has developed a special platform for interaction between IT companies, research institutes, industrial enterprises and government agencies. The creation of a register of domestic products, as well as interaction on this platform, will significantly expand the possibilities of technological cooperation between IT companies and industry, as well as stimulate the creation of a high-quality and competitive product that meets the needs of customers.

The special platform, in addition to the enterprise register, includes analytical information on the current state of industrial enterprises, forecasts for their development, as well as data on IT companies and research institutes, including information on domestic products and scientific research.

Проект «Одно село – один продукт» (ОСОП)

An investment proposal is a tool that you can use to present your investment idea and project to capacity investors and demonstrate its development prospects.

The main purpose of an investment proposal is to attract investment funds or capital.

The success of an investment proposal depends on its clarity, brevity and credibility. It is important that it is convincing and complies with all legal and regulatory requirements.

The attached PDF file contains investment proposals.

The sole negotiator on behalf of the Government of the Republic of Kazakhstan in discussing the prospective and conditions for the implementation of investment projects is JSC National Company “Kazakh Invest”. The "one window" for investors principle is applied, which allows for the effective resolution of issues related to the public services receipt and also provides measures of public support, including investment preferences, assistance in receiving permits for investment projects implementation and operation.

A specialized CRM system is used to effectively monitor the progress of projects. This system allows investors to send requests and initiatives, and also ensures transparency of all processes at each stage of investment. In the future, the company plans to become the leading agency for attracting foreign investment in Central Asia, the CIS countries and other countries with transition economies.

JSC "Kazakh Invest" was established in accordance with Resolution of the Government of the Republic of Kazakhstan with the aim of promoting sustainable socio-economic development of the country by attracting foreign investment in priority sectors of the economy and comprehensive support of investment projects.

According to the Decree of the President of the Republic of Kazakhstan dated December 26, 2018 No. 806, the rights of ownership and use of the block of shares of JSC NC “Kazakh Invest" were transferred to the Ministry of Foreign Affairs of the Republic of Kazakhstan.

The company performs the following functions:

- Single negotiator on behalf of the Government.

- One-stop shop principle for investors in Kazakhstan.

- Experts with deep knowledge of industries and local markets.

- Network of representatives abroad and in the regions of Kazakhstan.